Deep well credits, long a source of criticism from anti-fossil fuel activists and the Green Party as a fossil fuel subsidy that robs B.C. of its fair share of profits from natural gas extraction, are being eliminated.

The B.C. government today announced an overhaul of the way it taxes the oil and gas sector.

It is moving to a system that will tax oil and gas producers in B.C. at roughly the same rates as Alberta.

The government estimates the new royalty model will generate an average of $200 million a year in additional royalty revenue to the province – about $1 billion over five years.

"For too long, the system of royalties for oil and gas has set us up to a situation whereby, rather than British Columbians benefiting completely from these resources, we've seen extremely large profits for oil and gas companies, while British Columbians have had to pay more for heating costs as a result," said Premier John Horgan.

As of September 1, the deep well credit program in B.C. will be gone, replaced by a new royalty and tax model that will tax natural gas producers at higher rates. Other credits for marginal and low-value wells will also be eliminated.

The new rates are a 5% royalty for the first 12 months for new wells – a 2% increase over the current 3% rate.

Companies will then pay royalties rates based on profits – i.e. revenue minus costs – with “price sensitive” rates of 5% to 40%, once drilling costs are recovered. In other words, the royalties collected by the government will reflect natural gas prices, which have more than doubled since a year ago in Canada, and nearly tripled in the U.S.

"Establishing a rate that is price-sensitive will better reflect the value of the resource and provide a greater return to British Columbians," said Bruce Ralston, minister of Energy, Mines and Low Carbon Innovation.

"The new system will ensure the public a return of half the profits over the life of any oil and natural gas well."

Deep well credits on pre-existing wells will expire in four years. Until then, companies can still use them to reduce the royalties they pay, unless they decide to voluntarily transfer the credits to a credit bank for emissions reductions and “land healings” – i.e. land reclamation – over and above what is already required by regulation.

In response to criticisms that B.C.’s deep well credits had resulted in the B.C. government forgoing about $3 billion in oil and gas royalties and taxes, the John Horgan government commissioned Nancy Olewiler, a public policy professor at Simon Fraser University, and Jennifer Winter, associate professor of economics and scientific director of the energy and environmental policy research at the University of Calgary, to review B.C.'s oil and gas royalties and credits.

Their conclusion last year was that it was outdated, piecemeal, complex, and didn’t provide the societal benefits that they should. They pointed to Alberta as a possible model for modernizing B.C.'s royalty model.

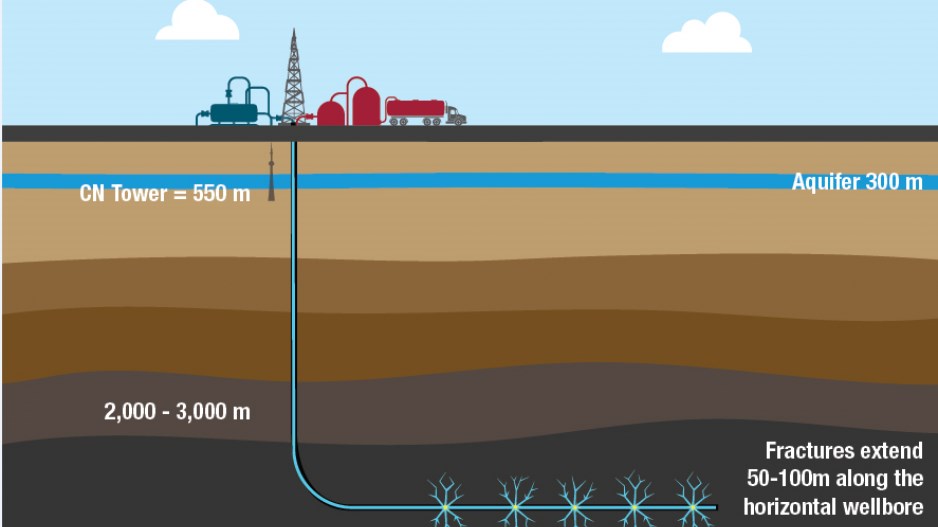

Deep well credits were implemented in 2003, when deep horizontal drilling and hydraulic fracturing was still a novel approach to oil and gas extraction. Since this approach was more capital intensive than conventional drilling, the credits were provided as an incentive to lure companies to northeastern B.C.

But horizontal drilling and fracking is now actually more conventional than “conventional” drilling in the U.S. and Western Canada.

The rates the B.C. government will charge are in line with what Alberta producers pay, B.C. government officials said Thursday at a press briefing.

However, there will be a three-year period where drillers in B.C. will be at a disadvantage to Alberta. In 2017, Alberta implemented a similar program to phase out deep well credits, but set the phase-out period at 10 years, whereas it has been set at four years in B.C. So between 2024 and 2027, Alberta companies with pre-existing wells will still benefit from credits, whereas B.C. companies won't.

That's unlikely to deter investment in B.C., however. B.C.’s Montney formation is rich in natural gas liquids (light oil, condensate, propane), and has new natural gas markets developing in the form of liquefied natural gas exports, so even with higher royalty rates, companies may still find B.C. a highly profitable region for natural gas extraction.

A bigger concern in B.C. right now is drilling permits that are on hold, while the B.C. government and Blueberry River First Nation sort out how to continue to allow natural gas extraction without infringing on the nation's Treaty 8 rights.

The Blueberry River First Nations won a court battle in which the courts ruled the B.C. government had infringed its treaty rights through decades of cumulative impacts from various industries, including natural gas extraction. The B.C. government and First Nations are still sorting out land use planning in the Treaty 8 region, which is in the heart of B.C. natural gas industry, and meanwhile some permits are on hold.